8a -Accidents & Responsabilities

ACCIDENTS & INSURANCE

Accidents happen when you least expect it. Be aware, be prepared!

The Major cause of accidents is a failure to give the right of way.

If you are involved in an accident: (IMPORTANT)

- Stop. Turn your contact off to avoid fire, and turn on your hazard lights.

Check yourself and your passengers for injuries… If you’re seriously injured, try not to move, and wait for emergency personnel. All injured people should remain seated (unless the car is on fire). - Call 911 FIRST Whether an accident is considered a minor fender-bender or a major collision, calling the police is important — and in some states, it’s legally required. The responding officers will fill out an accident report and document the scene, or instruct you to move your car if it is obstructing traffic.

If no one is injured (fender bender) after calling 911 and if your car is safe to drive and is causing a hazard where it is, pull it to the side of the road to a location that does not obstruct traffic and return to the scene.

- Exchange your info with other drivers involved:

Get witness contact info if possible. Take pictures. If the police are not coming (bender fender) Exchange your name, address, Driver’s License number, registration, and insurance information with other drivers involved. - Send a report to your insurance company and call them within 24 hours. If the accident involves an unattended vehicle or other property, you must leave a note to the owner with your name, address, driver’s license number, registration, and insurance information.

Why do the police need to be involved in a minor fender bender?

A minor fender bender still warrants a call to the police.

Nevada has a series of laws outlined in Nevada Revised Statutes 484E. They dictate when drivers need to call the police for a minor fender bender.

In all cases, the law requires the driver to call the police when any kind of accident occurs:

- Injuries – Nevada law 484E.030 requires drivers to call the police, no matter how large or small the injury.

- Property damage – All accidents involving property damage must be reported under Nevada Revised Statutes 484E.020.

- Unattended vehicles – If you strike an unattended vehicle, Nevada law 484E.040 requires you to call the police.

Some states require you to call the police only if there is apparent damage to a certain amount or higher. Other states may give you the option to file the police report yourself. Nevada doesn’t have laws like that. Whenever you’re in an accident, you should report it to the police.

FINANCIAL RESPONSIBILITY

If you are in an accident that is investigated by law enforcement

You must complete the accident report form (SR-1) if you are either the driver or the registered owner of the vehicle.

You can get a report form from any DMV office, the Nevada Highway Patrol, a local law enforcement agency, or the DMV official website at www.dmvnv.com.

Your insurance information and a description of damages or injuries will be sent to the DMV by the investigating officer.

Nevada is a "Fault" Car Accident State

Nevada follows a traditional “fault” system when it comes to financial responsibility for losses stemming from a car accident: injuries, lost income, vehicle damage, and so on. This means that the person who was at fault for causing the car accident is also responsible for any resulting harm (from a practical standpoint, the at-fault driver’s insurance carrier will absorb these losses, up to policy limits).

In Nevada, a person who suffers any kind of injury or damage due to an auto accident usually can proceed in one of three ways:

- by filing a claim with his or her own insurance company, assuming that the loss is covered under the policy (in this situation, the injured person’s insurance company will likely turn around and pursue a subrogation claim against the at-fault driver’s carrier)

- by filing a third-party claim directly with the at-fault driver’s insurance carrier, or

- by filing a personal injury lawsuit in civil court against the at-fault driver.

Note: In no-fault car insurance states, a claimant doesn’t usually have this same range of options. After a car accident in a no-fault state, you must turn to the personal injury protection coverage of your own car insurance policy for payment of medical bills and other out-of-pocket losses, regardless of who caused the crash. Only if your injuries reach a certain threshold can you step outside of no-fault and make a claim directly against the at-fault driver. But Nevada drivers don’t need to worry about no-fault after an in-state accident.

Police Reports

After a car accident, a police officer or some other member of local law enforcement may come to the scene, particularly if they know that someone was injured. If an officer came to the scene, they probably made a written accident report. Ask the traffic division of your local law enforcement agency how to get a copy.

Sometimes a police report plainly states an officer’s opinion that someone violated a specific traffic law and that the violation caused the accident. It may even state that the officer issued a citation. Other times, the report merely mentions negligent driving, without plainly stating that the violation caused the accident.

Regardless of how specific it is, any mention in a police report of a traffic law violation or careless driving by another person can serve as a great support in showing that the other person was at fault.

Leaving the Scene of an Accident

For any accident, the DMV Financial Responsibility Section determines:

—— Who was at fault,

—— If all vehicles or drivers were insured, and

—— The total amount of liability.

• If you are at fault and do not have liability insurance:

—— Your driver’s license and/or vehicle registration may be suspended,

—— You will have to post a deposit with the DMV to cover the costs of the accident, or

—— You must make arrangements with the other parties to pay for damages or injuries.

What Happens if You Leave the Scene of an Accident in Nevada?

If you have a driver’s license in the state of Nevada, you are legally obligated to adhere to the rules and regulations of the road. After an automobile accident, you are required to remain present at the accident until released by law enforcement or until you have exchanged information with the other driver. If you choose to leave the scene of the accident, you could face the harsh penalties of a hit-and-run incident – even if the collision was not your fault.

Penalties for Leaving the Scene of an Accident

The penalties will depend on the circumstances of the accident. However, some of the penalties you could face for leaving the scene include:

- Misdemeanor Hit and Run – NRS 484E.020. This occurs when there is property damage and you flee the scene of the accident. Penalties for this offense include up to six months in jail, a fine of up to $1,000, and up to six demerit points on your driver’s license.

- Felony Hit and Run – This happen when death or bodily injury occurs and you leave the scene. The penalties are much harsher for this offense and include two to 15 years in prison, a fine of up to $5,000, and a possible license suspension or permanent revocation.

Accidents happen when you least expect it. Be aware, be prepared!

Having an Accident with Someone Else's Car

When a teenager wants to play grown-up, showing off in front of his friend…

True Story:

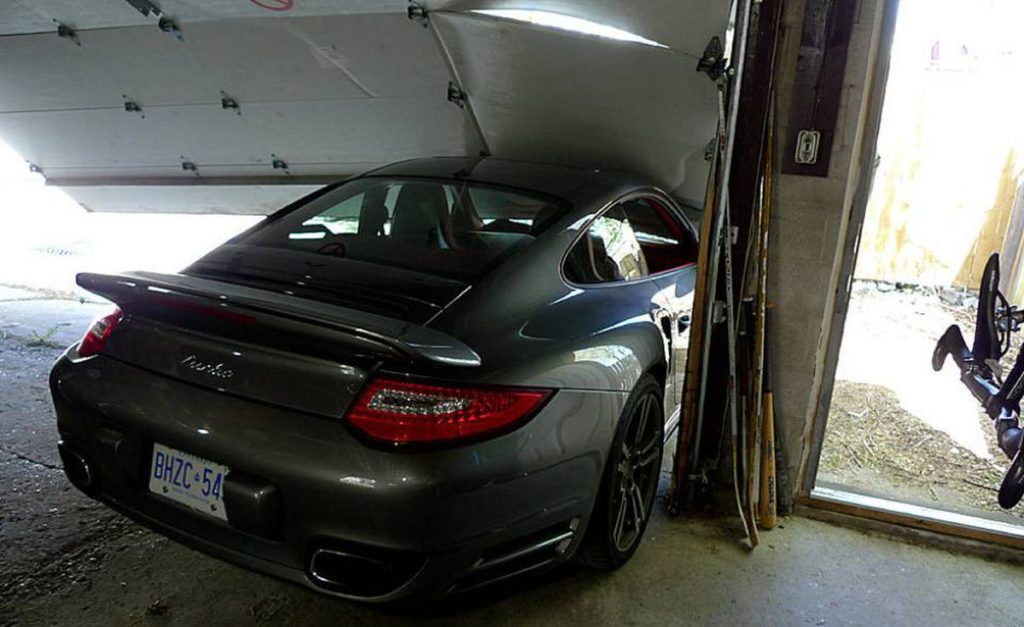

Canadian auto journalist Peter Cheney now likely regrets tossing the keys of a 500-hp Porsche 977 Turbo to his son,

Peter lived every automotive journalist’s worst nightmare when his son accidentally launched a brand new $180,000 Porsche 911 (997 Turbo 6 gear stick shift) through his garage door.

– “It’s what you get for not having your kid take driving classes,” said Peter.

– My son, Will, stuck his head into the office and asked me if he could show his buddy the Turbo. I told him to go ahead. He and his friends always checked out my cars.

Their main focus seemed to be the interior and stereo system – details I barely cared about.

– I shut down my computer and prepared to head to the office, smiling at the thought of a few minutes in the Turbo. As I headed out the back door, I saw my son running toward the house. His eyes were the size of dinner plates. He sputtered:

“Dad, the Porsche … the Porsche …”

– I walked past him into the garage. For nearly a minute, I was too dumbfounded to speak. The Turbo hadn’t rolled into the door – it had launched itself through the entire structure. In a distance of approximately four feet, the 500 hp Turbo had developed enough kinetic energy to blow the entire security door apart.

Parts of the roller mechanism were scattered through the alley. Dazed, I picked up a bent metal piece – it looked like a Crazy Bone, a toy Will had collected as a little boy. It seemed as if a giant blacksmith had smacked my beloved Porsche with a sledgehammer…

. When I parked it, the Turbo had been pristine. Now it looked like the car from Dukes of Hazard after a chase through the southern backwoods.

Luckily for him, his journal the Globe is sucking up the $11,000 in repair costs. (What else would they do? After all, the Globe is the largest national newspaper in Canada and probably one of Porsche Canada’s largest advertising clients). Cheney is, however, left with $2,700 in repair bills for his garage.

SR-22 Insurance: Proof of Financial Responsibility

Some drivers may be required to file an SR-22 form as a condition of reinstatement. SR-22 is a form of liability insurance on a driver’s license that allows the Department to monitor the insurance of a suspended and/or revoked driver’s record through information received from the driver’s insurance company. The cost of this insurance is dependent upon the structure of the insurance company.

The period of coverage begins when you reinstate, and you need only to file this form once. Do not purchase SR-22 coverage until you have met all other reinstatement requirements and are ready to apply for your license.

Nevada requires that automobile liability insurance policies carry minimum coverage of $15,000 for bodily injury or death of one person in any one accident; $30,000 for bodily injury or death of two or more persons in any one accident; and $10,000 for injury to or destruction of property of others in any one accident. Coverage must be reported and provided by an insurance company authorized to do business in Nevada. No out-of-state insurance will be accepted.

The state of Nevada requires that all registered motor vehicles be covered by liability insurance. The Department of Motor Vehicles has established a Nevada Liability Insurance Validation Electronically (NV LIVE) program to identify uninsured motorists and enhance the public safety of Nevada residents. Through the use of computer programs in partnership with licensed Nevada insurance companies, the DMV has been very successful in identifying registration records where insurance has been terminated or had a lapse in coverage.

If your registration is suspended for a lapse of insurance and no new coverage for that time frame has been obtained, you will be required to pay a reinstatement fee and applicable fines (starting at $250 and totaling up to $1,750) for each registered vehicle covered by that insurance.

Additional penalties may include an SR-22 and/or a 30-day suspension of your driver’s license.

10 tips to Make you Look Like a Pro

3 tips to Compare Insurance Rates

End of Topic 8a. ACCIDENTS AND RESPONSIBILITIES.

Next Step: QUIZ # 8